The concept of open access is becoming increasingly important in today's telecommunications landscape. More and more operators are recognizing not only the potential for a fairer market structure, but also the many other benefits. But what exactly is Open Access? How does it fit into existing structures? And above all, what new opportunities are opening up for telecommunications companies?

Network utilization is going downhill

While the broadband market in Germany has reached a certain level of maturity, the majority of German TSPs continue to expand their fiber optic infrastructure. In addition to large national providers, many small, often regional providers are also driving the growth of the network. These providers own the entire passive infrastructure, usually work with an active network partner and serve their own end customers. External factors such as higher costs due to inflation and a lack of capacity in civil engineering, as well as higher financing costs due to interest rates, are representing various challenges for such providers.

Internal factors, such as the lack of expected network utilization are not being met for the majority of TSPs. The take-up rate is an important indicator, as the ratio of booked fiber optic connections (Homes Activated) to those actually available (Homes Connected), can only be increased to a limited extent through improved marketing and sales strategies. For the foreseeable future, many private customers are sufficiently equipped with copper double-wire (xDSL) or coaxial cable infrastructures (DOCSIS-based connections). Chances to switch them to a fiber optic connection to increase their available performance features such as download/upload speeds and latencies are minor.

Network use is further complicated by the challenges of rollout: the lack of skilled workers is jeopardizing the achievement of the Houses Passed targets, i.e. the households along whose buildings the fiber optic lines run, and is increasing the risk for the connected households, especially in the case of FTTH (Fiber to the Home). This is because bringing fiber to the home requires coordination with a large number of parties: In addition to the construction companies, there are the installation companies for the in-house cabling, as well as the presence and consent of the homeowners or tenants.

Although the widely predicted wave of consolidation has not yet occurred, several TSPs have exited the market since the end of 2022, such as Hello Fiber and Glasfaser Direkt. Municipal utilities are also reducing or even discontinuing their local broadband deployments. The fact that there are fewer and fewer areas that are attractive for fiber expansion means that existing fiber networks are being overbuilt by other TSPs. As a result, two or more competitors are offering their products to end customers on the basis of their own infrastructure. In Berlin, for example, 12 companies1 have currently announced – and partly realized – their expansion plans for 3.5 million fiber connections2 which are significantly more than 2.2 million existing households in Berlin.

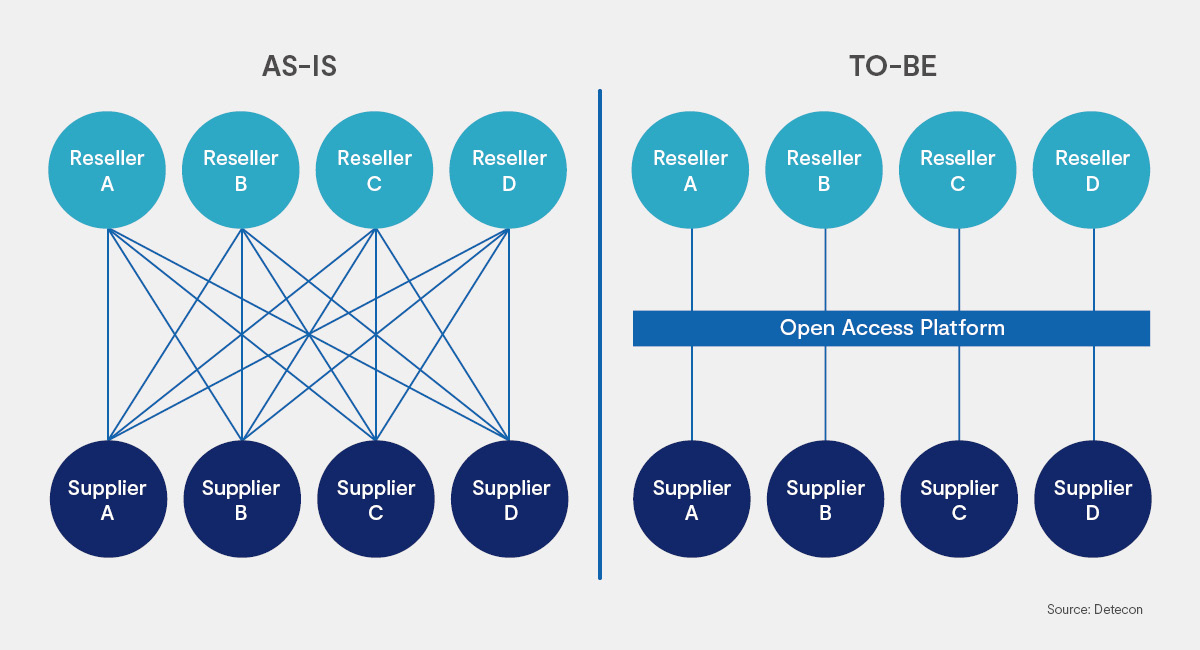

One way to increase network utilization is to market the infrastructure not only yourself, but also through partners who offer it to their own end customers. In fact, the business models of FiberCos (such as Deutsche Glasfaser or Deutsche GigaNetz) and integrated telcos provides preliminaries to wholesale partners: OXG (Vodafone & Meridiam), GlasfaserPlus (Telekom Deutschland & IFM Investor) and Unsere Grüne Glasfaser (Telefónica & Allianz). However, even the retail oriented TSPs are increasingly focusing on wholesale.

How does open access fit into these market structures?

Open access is a special form of a wholesale business model as well as indicated in the German Telecommunications Act (TKG). § 155 (1) requires operators or owners of public telecommunications networks to grant other operators "non-discriminatory, open network access to publicly financed telecommunications lines or networks on fair and reasonable terms". This is defined more precisely in Art. 8 Par. 1 of the Gigabit framework regulation3, which states that "open and non-discriminatory access to the infrastructures established in the subsidized network, in particular access to empty ducts and to the cable distribution frame or collocation areas to be provided, access to dark fiber, bitstream access and fully physically unbundled access to the local loop" must be guaranteed.

However, open access is not only an issue for subsidized rollout, but also for self-service rollout. The number of publicly announced open access partnerships is increasing, and yet, it is not clear whether these are non-discriminatory and open or simply exclusive wholesale agreements between infrastructure owners and network operators.

There are three levels of open access:

I. Medium

In the current discussion, reference is made almost exclusively to FTTB/H infrastructures, but open access is also possible for access networks based on copper wire pairs (xDSL) or TV cable (DOCSIS). For example, Tele Columbus already announced a wholesale agreement for its own TV cable network with Telefónica in 2021, which it classified as open access.4

II. Value Creation Level

The above-mentioned open and non-discriminatory network access does not have to be limited to a specific value-added level, even if most agreements are based on layer 2 bitstream access (L2-BSA), i.e. an active upstream product. Dark fiber or even empty conduit capacity can also serve as a basis.

III. End Customer Access

Open access typically refers to the part of the telecommunications infrastructure up to the house connection, i.e. network level 3 (NL3). However, open access also covers shared use claims from the TKG amendment for the in-house infrastructure up to the termination socket (NL4). In future, this could also become an issue for in-home infrastructures (NL5).

Will open access be TSPs’ life-saver?

Open access offers a wide range of opportunities and benefits for TSPs:

-

Efficient use of infrastructure: With open access, fiber optic networks can be shared among TCUs, allowing for more efficient use of infrastructure. As a result, investments in infrastructure expansion can be better leveraged and overbuilding can be avoided.

-

Expanded customer offerings: By using open access platforms, TCUs can offer a wider range of services. Customers can choose from a wider range of internet providers and tariffs, resulting in higher customer satisfaction.

- Reduced investment costs: Maintenance and network expansion costs can be dramatically reduced by sharing infrastructure with other operators, increasing financial flexibility. This frees up capital that carriers can use for other business investments.

-

Accelerated time to market: The time saved on building separate telecom infrastructure can be used by the telecom operator to launch other services it has developed more quickly. This helps the business stay competitive and adapt to changing customer needs.

Open access networks require platforms that allow carriers to offer their infrastructure to other operators and provide non-discriminatory access to other fiber networks. The use of such platforms, such as vitroconnect or Plusnet, offers a number of options for implementing and managing open access. These include

- Access to network resources: Open access platforms offer access to a variety of infrastructures (COAX, copper or fiber - in the future also satellite) that can be used by a wide range of TCUs.

- Partnership management: A variety of tools can be used on open access platforms to create contracts, services and billing, reducing the complexity of collaboration between TCUs and improving efficiency.

- Quality assurance support: Open access platforms, with their monitoring mechanisms, can be used to ensure service functionality and customer satisfaction, thereby improving service quality.

In summary, open access to other providers' infrastructures generates higher efficiency and expands the range of services offered to customers. At the same time, it can reduce investment costs for infrastructure expansion and accelerates time to market. Platforms that provide non-discriminatory access will play an increasingly important role in managing and facilitating partnerships between Internet service providers.

1. Colt, Deutsche GigaNetz, DNS:NET, Deutsche Telekom, Global Connect, Tele Columbus, 1und1 Versatel, Vattenfall Eurofiber, Vodafone, OXG, Open Infra and Deutsche Glasfaser

2. Senate Department for Economics, Energy and Public Enterprises, press release from 29.02.2024