Carve-outs, which involve the removal of a business unit from a company, are complex transactions that require careful planning and coordination to address their multifaceted challenges. How can such a divestiture project be navigated to ensure a successful transition?

Independently of the economic situation in the market, companies continuously review their business portfolios to realize their full value potential. Increasing the value of a business portfolio involves not only acquiring or merging businesses but also selling operations that are not aligned with the strategy or are simply not productive. Furthermore, there might be other drivers behind the selling, such as commercial aspects, financial pressures, and regulatory requirements. A good example in the telecommunication industry is the consolidation taking place in recent years, where an increasing number of telco operators divest non-core assets (e.g., towers and fiber networks) as part of a broader portfolio rationalization to focus more on their core business.

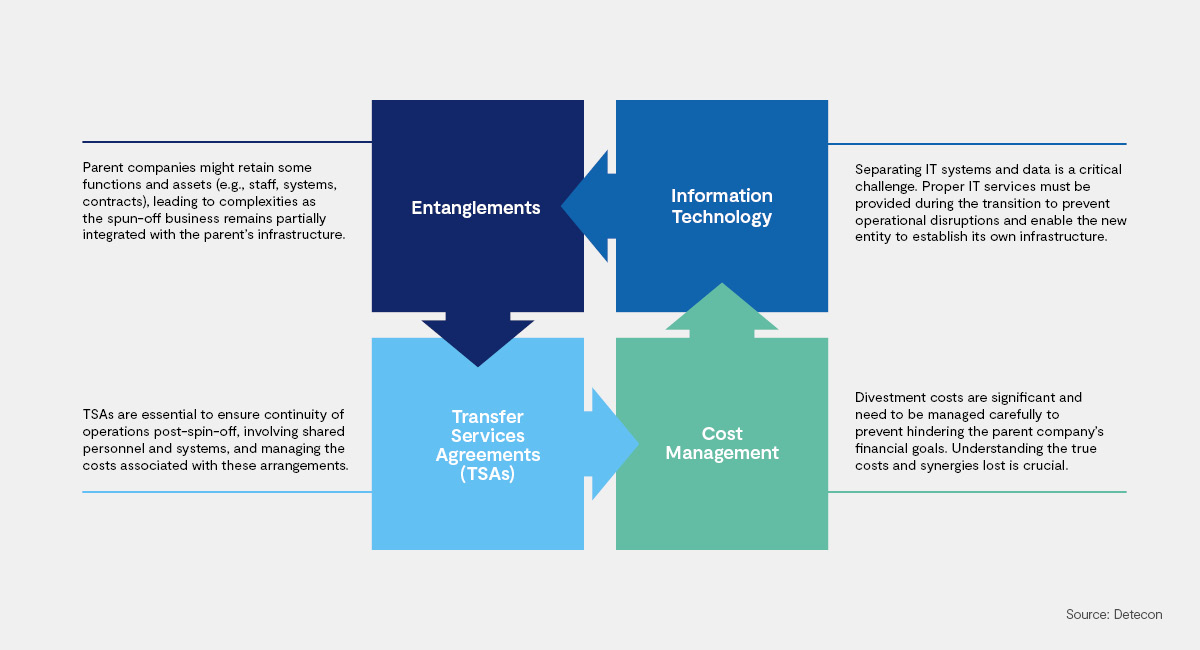

Carve-outs present unique challenges for both sellers (parent companies) and investors (potential buyers). Sellers face issues such as valuation discrepancies, complex financial reporting and accounting separation, significant tax considerations, employee transition difficulties, and decisions regarding which assets and liabilities to retain. Investors must overcome hurdles in due diligence, securing financing, integrating the acquired business, ensuring business continuity, obtaining regulatory approvals, realizing synergies, managing change, and rebranding efforts. Both parties must navigate these complexities to achieve a successful carve-out and transition (see Exhibit 1).

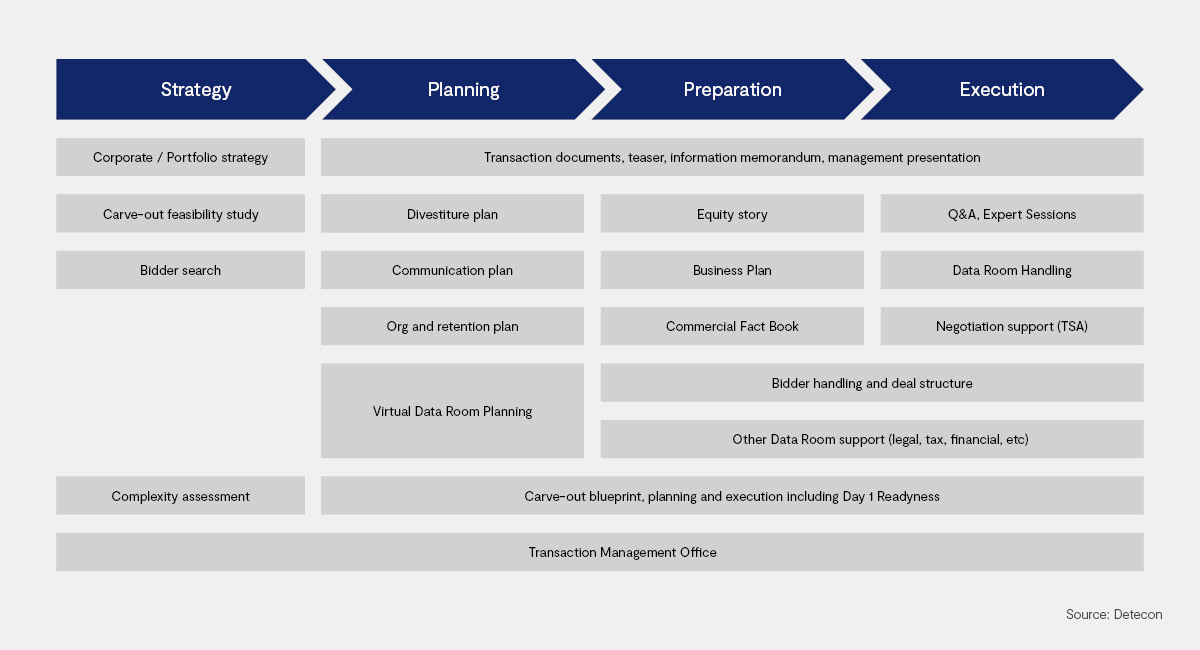

A divestiture project requires capabilities spanning the entire value chain, including end-to-end support from strategy to execution, involving collaboration with internal and external stakeholders (see Exhibit 2).

Strategic identification of carve-out opportunities

A carve-out, the removal of a business unit from a company, aims to establish it as a stand-alone company or sell it to another company. When developing a carve-out strategy, it is important to consider both the immediate goals and operational implementation, as well as the bigger picture represented by the entire company portfolio. Analyzing a portfolio can have a significant impact on this strategy decision. By systematically evaluating the various business units or product lines, a company can identify which units fit its long-term strategic focus and which do not. Criteria such as revenue growth, market share, strategic importance, and resource consumption can help identify which business units are core components of the company and which are potential candidates for carve-outs.

With this integrated approach, the carve-out process is not viewed solely as a reaction to current market conditions or short-term financial considerations. Rather, it is based on sound analysis that ensures it is in line with the company's long-term strategic objectives. This ensures that both the carve-out decision and its subsequent implementation contribute optimally to the company's overall picture and strengthen its strategic direction. It can be useful to involve external experts in this process to optimize the process.

Careful planning and coordination

The planning process requires approval from decision-makers and developing a detailed organizational plan, while ensuring key personnel retention and assembling a multidisciplinary project team. In addition, throughout the process, it is critical to have a clear communication plan that ensures all stakeholders are regularly informed, minimizing uncertainty and building trust. Such an integrated approach ensures a systematic and efficient carve-out process.

Preparation involves creating essential documents, such as the equity story and business plan, which outline the future strategy and viability of the spun-off entity. Commercial due diligence assesses the business model's sustainability and market positioning. The carve-out plan, along with a Day 1 Readiness (D1R) Assessment, ensures the new entity's readiness and smooth transition to independence, often supported by Transition Service Agreements (TSAs) to maintain operations during the transition.

Ensuring smooth and efficient progress

Finally, during the execution phase of a carve-out, the Transaction Management Office (TMO) plays a critical role in managing the transaction's daily operations. The TMO ensures the deal is executed successfully, on time, and within budget, while protecting stakeholders' interests, minimizing risks, and maximizing value creation. Effective TMOs oversee the transaction lifecycle, ensuring smooth and efficient progress. Post-transaction, the focus shifts to Day 1 Readiness, where the newly independent company must begin operations seamlessly without disrupting business processes. This involves a holistic approach to identify interdependencies and coordinate processes. Readiness certifications or Ready Checkpoints (RCPs) are conducted to avoid surprises and maintain business continuity.

In conclusion, carve-outs are complex transactions that require careful planning and coordination to address the multifaceted challenges they present. Ensuring operational continuity through Transfer Services Agreements, effectively managing entanglements between the parent company, the divestiture, and handling the separation of IT systems are critical to a successful carve-out. Additionally, controlling the associated costs is vital to achieving the financial goals of the parent company and ensuring the spun-off entity can operate independently. By strategically addressing these challenges, both buyers and sellers can maximize the value and potential of the divested business, paving the way for future growth and success.