ESG factors are becoming increasingly crucial during mergers and acquisitions around the world. Decision-makers on all sides of a transaction have recognized that sustainability components are of growing relevance for the success or failure of a corporate transaction.

Why ESG plays a role

From selection and initial informal integration plans to post-acquisition integration of the target company, ESG considerations are key factors in investment decisions. While these latter activities are certainly aimed at exploiting opportunities for creation of forward-looking added value, they are also expected to aid companies in the achievement of their own sustainability goals. With this in mind, acquirers are paying ever more attention to whether the target company has defined its own sustainability strategy and regularly reports on the results.

Regardless of whether the due diligence is public or private, the same level of due diligence commonly demanded for widely recognized due diligence topics such as financial performance and technical and legal assessments is more and more frequently required with respect to ESG topics. Companies now recognize that every acquisition also entails a number of various ESG risks that can have substantial financial and non-financial impacts, so the aim of meticulous ESG due diligence is to identify, assess, and ultimately minimize these additional risks.

Consequently, parties involved in transaction worldwide are insisting with growing frequency that sustainability factors be taken into account during the review process. Moreover, governments and authorities around the world are also tightening the requirements for sustainability reporting. Failure to disclose environmental and social aspects or the determination of a mismatch between ESG objectives and actions carries the risk of post-transaction litigation. Given the increasing number of ESG disclosure requirements on many markets, such risks may be exacerbated during public transactions.

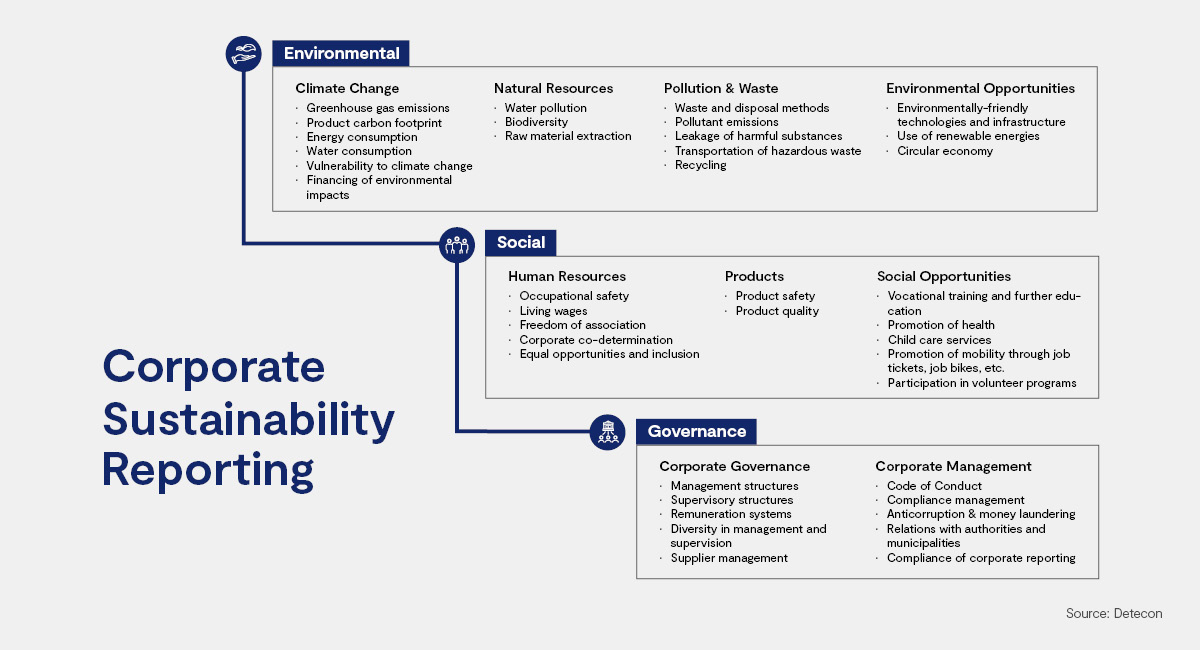

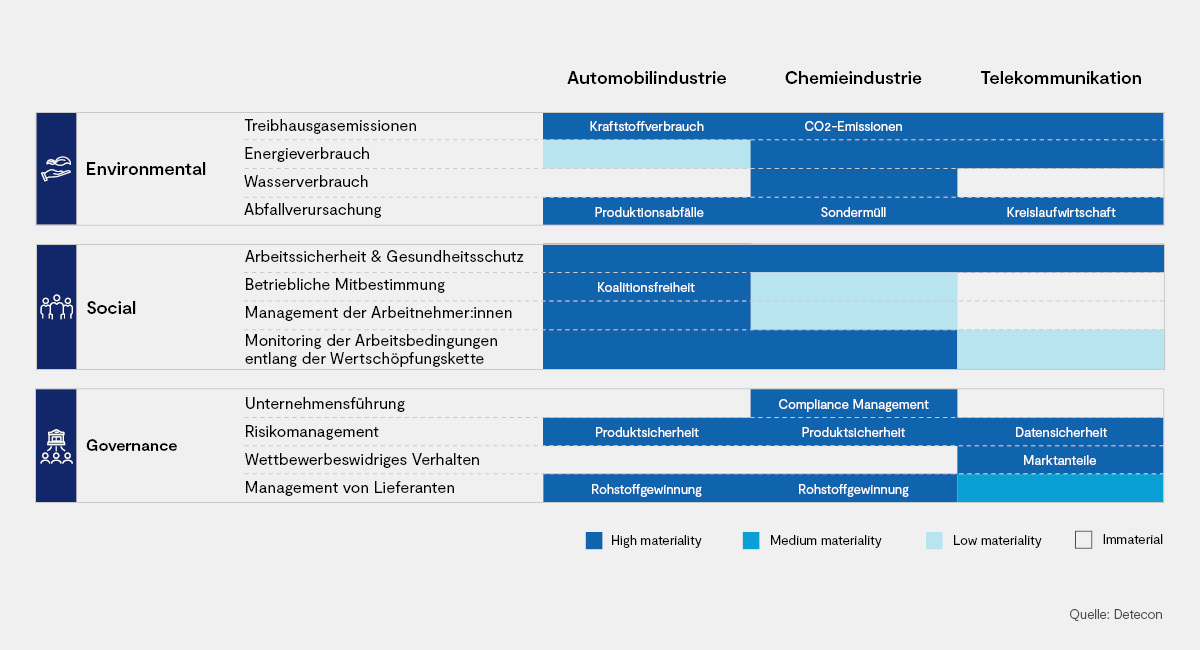

As of this moment, no generally accepted standards of sustainability reporting have been established. The regulations on reporting are extensive in their scope, yet are in part generally applicable, in part sector-specific, and in many cases open to interpretation. In this sense, ESG reporting should be tailored to the circumstances of the company’s business sector and its level of maturity. For one company, key sustainability issues might be the carbon footprint and the credibility of net zero targets while for another, labor standards and human rights along the supply chain could pose a much greater challenge. Fundamental ESG elements can therefore affect due diligence processes in different ways.

Dual materiality and priorities

Companies generally operate in a complex and changing market environment, requiring an ongoing review of their own ESG targets and the associated measures enabling them to monitor opportunities and risks at all times. Analysis of the fundamental sustainability issues is a critical tool for performance of these tasks. Such a materiality analysis supports the company in the review of its sustainability goals and in the reconciliation of the targets with the expectations of its stakeholders. Stakeholders of a company encompass all internal and external parties who have an interest in the company’s activities, impacts, and results and include shareholders, employees, customers, and suppliers. The principle of dual materiality for sustainability reporting requires analysis and reporting on the following aspects:

- Impact of the relevant ESG regulations on the company (so-called outside-in perspective)

- Impact of the company on the environment (inside-out perspective)

- Impact relating to key financial and non-financial (sustainable) performance factors as well as their opportunities and risks

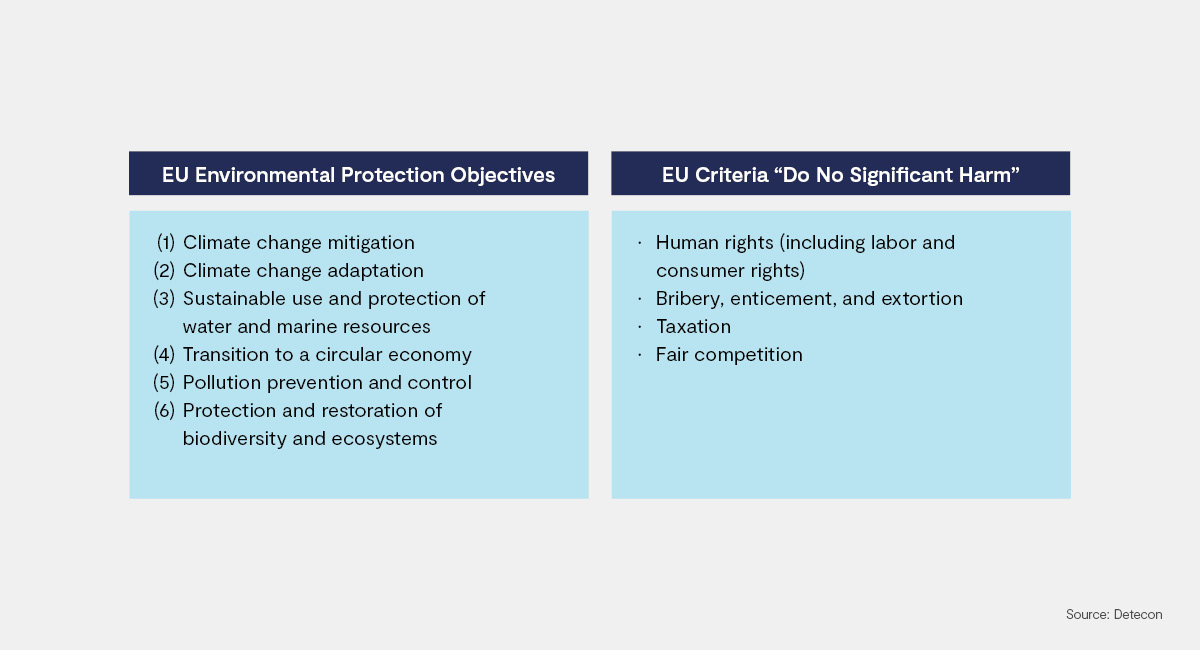

The most relevant sustainability issues are identified by a company’s own analysis of ESG factors in accordance with the principle of dual materiality and its consideration of internal and external sources such as industry standards, legal requirements (including the six environmental objectives and the Do No Significant Harm criteria of the EU), rating criteria, and comparisons with the competition.

Stakeholder surveys facilitate the prioritization of Identified sustainability issues. If the target company is aware of its ESG impacts and manages and reports them appropriately, it can proceed optimally with regard to risk minimization, opportunity maximization, resource allocation, and the scope of reporting.

During due diligence, materiality must be reconsidered and assessed from the starting point of the relevant sustainability issues of each of the parties to the transaction.

- The fundamental ESG factors must be identified and assessed by the due diligence partners both singly and as a post-merger combination. The assessment of materiality can be based on the projected factors influencing financial and non-financial post-merger performance and their significance for stakeholders.

- The assessment of materiality within a due diligence process can, for example, be based on industry guidelines such as the SASB® Standards. The objective of the SASB® Standards is the standardization of the transparency of sustainability issues as specific to a given industry. ESG ratings are another way of assessing materiality in accordance with objective standards. ESG ratings are available for either single companies or entire industries and provide a further solid basis for materiality analysis and risk assessment.

- Due diligence should provide an overall structural target image that clearly and transparently depicts possible synergies of ESG factors and effects on future sustainability performance. The result of the materiality analysis proves to be a strategic instrument for creating transparency on key sustainability issues and the associated opportunities and risks with financial or non-financial implications for the involved transaction parties.

Sustainability metrics and possible influencing factors

Single ESG factors can vary in their influence on due diligence.

Environment — Environmental factors encompass a broad range of possible influences such as greenhouse gas emissions, energy consumption, use of renewable energies, extraction of raw materials, waste management, contribution to the circular economy, etc. More precise forecasts on the effects of climate change are the subject of current research. An assessment of the effects of climate change on the involved companies and the merger is required for medium and long-term forecasting of environmental performance after the corporate merger, including such aspects as physical risks (e.g., temperature changes, changes in precipitation levels, rising sea levels) and their impact on productivity, material assets, and regulatory measures.

Social — Social factors reflect a company’s commitment to ethical practices, social responsibility, and the promotion of a positive impact on society. The most important dimensions include human rights, human capital, social issues, social responsibility and initiatives for the improvement of working conditions, social equality, and inclusion. The impact of social factors on the merged enterprises and the prospects of the merger’s success are of major significance for the company’s reputation. Failure to comply with occupational health and safety regulations and human rights, possible dispossession, exploitation of raw materials, etc. can, under certain circumstances, devastate the image of the involved companies.

Governance — Governance factors reveal whether a company acts responsibly during the conduct of its business. They concern the companies’ interactions with external stakeholders, including supervisory boards, shareholders, authorities and governments, customers, and suppliers. Governance factors serve as an integrative influence on the corporate structure and the ability to create the necessary transparency, fulfill accountability obligations, identify and avoid risks, and protect and satisfy the rights of business owners, stakeholders, customers and suppliers. Poor product quality, a lack of data protection, or failure to maintain safe working conditions along the supply chain can result in substantial financial harm and call the integrity of the company into question.

Best practices for acquirers and sellers

The best practices for ESG due diligence projects from an acquirer’s perspective are summarized below.

- Conduct comprehensive ESG due diligence so that you fully understand the target company’s material opportunities and risks, and use the insights you have gained to make informed decisions about the financial and non-financial success and risk factors.

- Look for evidence of greenwashing — a constant issue — and assure yourself of the completeness of pertinent sustainability data and of information about any litigation and regulatory actions.

- Use sustainability reporting as a test. If the company is not meeting its ESG obligations, what does this say about its corporate reporting in general?

- The sustainability factor was for many years a little-used instrument in M&A transactions. However, ESG is on the advance. The latest trends are coming to the fore as methods for the reduction of risk and augmentation of value.

ESG due diligence processes should include the following best practices to obtain an optimal valuation from a seller’s perspective.

- Carefully prepare a due diligence review revolving around ESG reporting and plans. Ensure that the relevant data are complete and transparent.

- Establish a working group to monitor the company’s fulfillment of its ESG commitments and its initiation of the necessary actions for all sustainability factors so that it has the best chance of posting the highest possible score.

- Conduct a voluntary external review of sustainability reporting to obtain objective evidence of data quality.

- Consolidate the company’s ESG ratings.

The inclusion of ESG criteria into due diligence processes represents an important step towards responsible corporate governance. The integration of ESG into due diligence processes does more than minimize risks; it offers companies the opportunity to identify new growth opportunities as well. It is a holistic approach that strengthens both financial performance and sustainable responsibility. The road to a sustainable future begins with a conscious decision in favor of corporate social responsibility and meaningful reporting. Taking sustainability factors into account during due diligence enables companies to manage risks more effectively while simultaneously developing sustainable shareholder value.